It Was the Best of Times, It Was the Worst of Times: How the Premium Market Offers Translators Prosperity in an Era of Collapsing Bulk-Market Rates

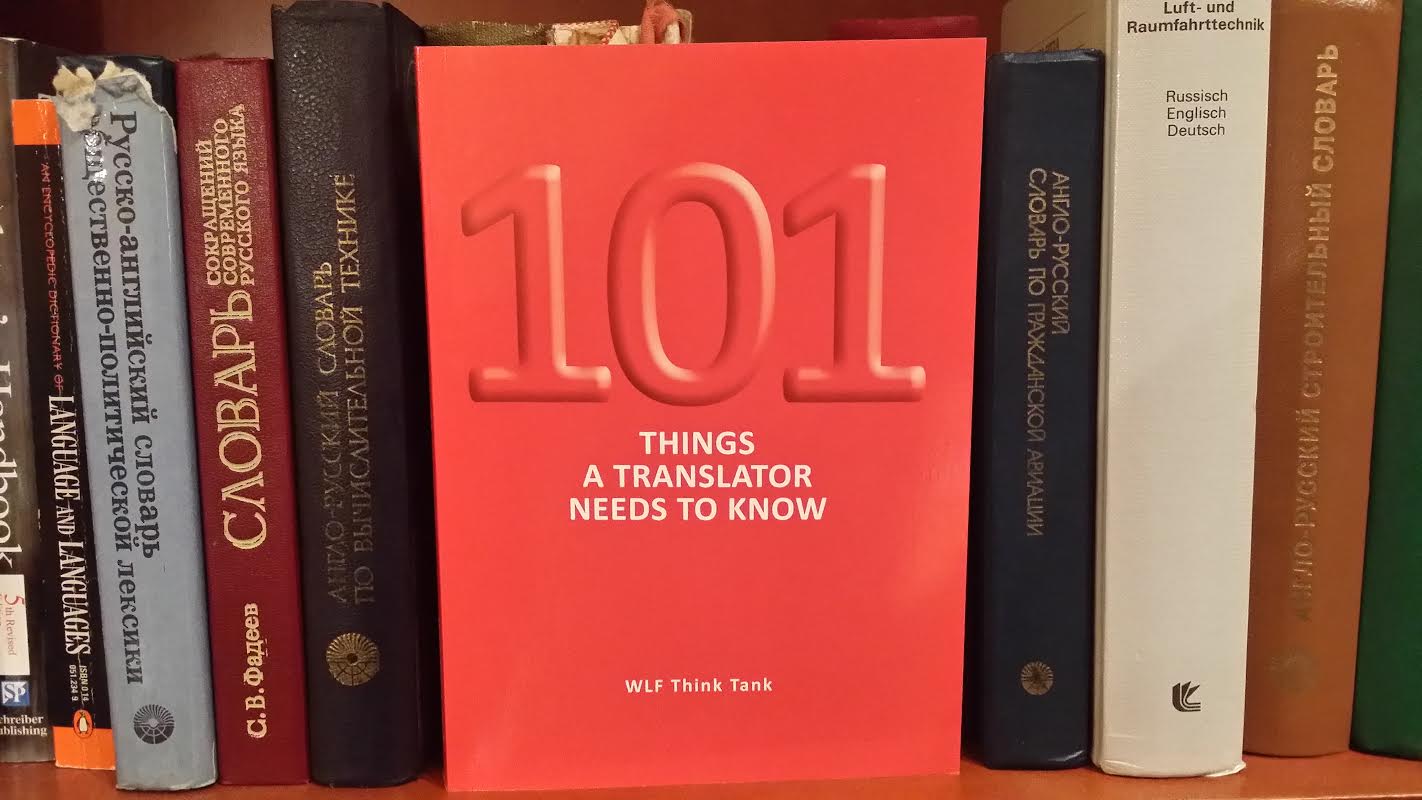

The skill set required to succeed at professional translation is so demanding, extensive, persistent and endlessly expanding that “being bilingual” falls several light-years short of even qualifying for consideration.

This holds true for successful translators working in every sector of the translation market.

After all, translation is, among other things, the craft of leveraging every aspect of your life-long experience, training, subject-matter expertise, writing skills and cultural sense in a way that allows you to project all that collective and hard-earned knowledge onto the page in a compelling and authoritative narrative.

So it makes sense that the more focused, targeted and specialized that expertise, the more specialized the market served.

And this is where it gets complicated.

It’s perhaps not surprising that since translation is the gateway through which all globalized commerce must pass, the translation market itself is very far from homogenous in a way that would make it easy to identify these specialty disciplines and markets.

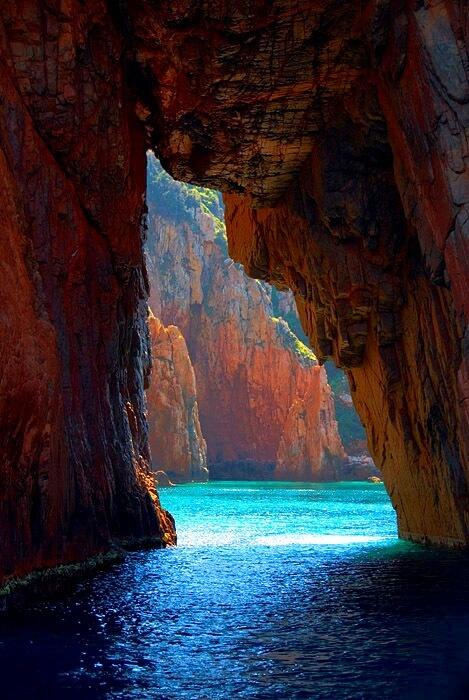

In reality the translation market is a wildly expanding explosive galaxy of massively divergent markets, sectors, sub-sectors, specialties and requirements.

It manifests an almost unfathomable agility to expand and evolve very rapidly to serve all the global markets it supports.

Despite this chaos, there does seem to have emerged over time a general delineation that helps us make sense of this enormous explosive cloud.

Bulk vs. Premium

We have found it useful to distinguish between what is referred to as the “bulk market,” where translation is essentially a support function – where knowing what the text or webpage or software dialog generally means is good enough – and what has come to be called the “premium market,” where getting the translation exactly, precisely, elegantly, authoritatively and compelling right is necessary because of the enormous stakes involved at that level of the market.

The bulk market, perhaps not surprisingly, tends to dominate discussions of the industry. It is often treated as though it were the entire industry. This is why most surveys and studies – even those that are marketed and sold aggressively for thousands of dollars – tend to consist largely of self-reported data exclusively from large bulk-market translation companies that in turn buy these surveys, resulting in a lopsided, limited and ultimately highly distorted view.

It’s as though having first discovered the primitive optical telescope, astronomers declared the game over. What they see in the sky with their own eyes is all there is. They never expanded their reach into radio or far-infrared astronomy, or launched orbital telescopes to peer farther into space and hence deeper back into time.

The analogy is useful because it’s exceedingly hard to accurately measure the size of the translation industry or accurately identify its “quality” segments.

The Quality Continuum

The translation industry is best represented as a very long continuum that encompasses all market segments, with raw bulk free machine translation (MT) at one end and $25,000 tag line translations of three words at the other.

And it’s far more accurate to characterize the “quality” continuum in terms of gradual and consistent gradations of shade rather than in terms of clear differentiating boundary lines.

So to be clear, the “premium vs. bulk” dichotomy is a form of shorthand only.

Having said that, it’s still quite useful for how it illuminates markets that are not always screaming for recognition.

For example, the premium sector includes commercial segments that are fiercely guarded and often shrouded in secrecy to prevent additional competition. Many of these are boutique translator-owned companies, marketing corporations, multimedia conglomerates, think tanks, government agencies, regulatory bodies, and even embedded subsidiaries in multinational corporations that deliberately fly under the radar of “research” companies to avoid alerting other companies to their profitable businesses.

Pure translation alone in the high-end expert pharmaceutical, medical device and IP litigation as well as the premium legal, financial and marketing sectors across all languages and in all countries dwarfs the entire global IT localization industry, for example, by about two to three orders of magnitude.

There are some years where one single IP pharmaceutical litigation case in Japanese-English alone will run into the $10 – $20 million range.

That’s one single translation project in one single language pair.

And the net profit margins in the premium market are considerably higher.

Value Proposition: Cost of Failure

While it’s true that the premium market tends to operate at higher prices, the market really operates on a completely different value proposition than does the bulk market.

That proposition is this: The cost of failure is dramatically higher than the cost of performance.

So in the premium market, the cost of translation errors – liability, regulatory failure, loss of life, damaging publicity or significant loss of prestige – far outweighs the often much higher cost of “getting the translation precisely right.”

Paying whatever cost premium for translation that is necessary to prevent the cost of failure is viewed as a wise investment.

In the bulk market, the value proposition is inverted. The cost of failure is low, so there is no corresponding push to invest in getting it right.

Rates are lower. Sometimes dramatically lower. And falling.

This can be tested by comparison to the dynamics of other industries, too. The cost of failure for a Walmart product is very low – the consumer almost expects it to fall apart. It’s the same with cheap online localization and “just good enough to understand it” bulk translation.

But a fractured fuel pump on a Boeing commercial aircraft in flight has an enormous cost of failure, so several layers of review, ongoing maintenance and testing as well as regulatory enforcement are built around it in an effort to ensure that does not happen, a process which drives up fuel pump manufacturing costs dramatically.

When the failure of an IPO or the collapse of a deal due to a translation-related regulatory failure or when nuclear weapons are improperly dismantled or lost to unknown people – that’s a very, very high cost of failure.

Budgets necessarily expand to pay a premium for translation expertise in these cases.

Of course, translators who want to play in this market must have developed Boeing-quality translation skills through narrow specialization, though, not Walmart-quality generalist abilities.

This means that they must specialize, evaluate, validate, collaborate and continuously improve.

Skill Sets

In brief, the difference between a bulk-market translator and premium-market translator can be summarized as follows.

While bulk-market translators’ heads are buried in dictionaries, premium market translators are buried inside their clients’ heads.

By that I mean that it’s an environment where your subject-matter expertise must absolutely be on a par with your customer’s subject-matter expertise. And it’s their core business, so that’s a very high bar. This requires that you specialize. Intensely.

And your writing skills in your target language must be equally compelling.

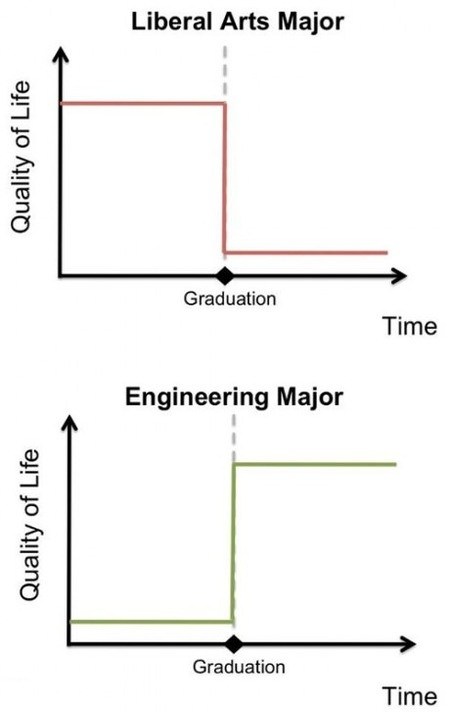

A helpful analogy to illustrate the difference between the premium market and the bulk market can be found in the health-care industry in the US.

This demonstrates the correlation in another profession between a pure laser focus on a single specialty over a career and higher remuneration.

It also clearly shows that we can appreciate the very significant training and skills required of practitioners to succeed in any sector of the translation market.

Translation vs. Health Care

The bulk market in translation is similar to the general practitioner (GP) physician market in the US health-care industry.

Yes, general practitioner physicians are exceedingly well-trained, work to a high standard and gave up most of their early adult lives to work in poverty while learning to hone their craft. They tackle a wide variety of different cases and enjoy and perhaps even thrive on that variety. They cure a lot of disease and save many lives. There’s actually a shortage of them in the US right now in rural communities, but their earning power peaks out at the floor of the medical industry’s premium market.

They refer out cases and patients that require greater expertise to the specialists.

The premium market in translation is similar the Board Certified specialist physician market in the US health-care industry.

They too are exceedingly well-trained. They share the first 5 years of training with the GPs (4 years medical school + 1 year internship) but then begin a whole new adventure, measured in yet another 5 years, depending on the specialty. They embark on this endless deep dive to develop increasingly well-honed skills in one specific area of specialization.

Their lives are more defined by the patients and cases they don’t see rather than by the ones they do. They see cases and patients the GPs refer to them. They consult constantly with their other Board-Certified specialists on the most difficult cases and conduct research to advance best practices.

Their remuneration is typically considerably higher than what is observed in the GP market.

Like any analogy, this one is imperfect.

Premium-market translators will now and then work outside their primary specialty, but it’s not very common in the US to see a Board Certified cardiovascular radiologist, for example, working as a primary care physician in a health clinic.

Part of the reason is that the medical industry in the US is tightly regulated and licensed and translation is surely at the other end of that spectrum.

So in our industry we must rely more on the honor system and appeal to best practices and professionalism when claiming competence in language directions and levels of subject-matter expertise.

Expanding Demand and Market Rates

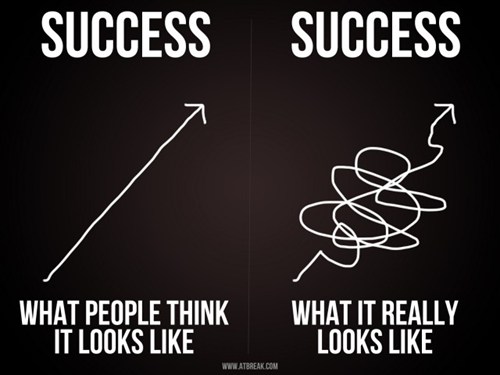

We see that the premium sector of the industry is continuing to expand – and rates are rising – which is in stark contrast to the realities of downward rate pressures in the bulk market today.

The fact that the two markets appear to be moving in opposite directions at an accelerating pace is revealing.

This makes it even more urgent to sound the alarm for all translators and encourage them to begin to make the enormous investment in time to specialize, elevate their subject-matter expertise and hone their writing skills in collaboration with their colleagues to jump upmarket as quickly as possible.